Risk Management

Early identification, assessment and mitigation of the principal risks are all integral to the management and governance processes operating within Dana Gas. Effective business risk management processes are essential to the efficient operation of projects, business units, central functions and the Group.

Dana Gas has fully adopted best practice in Enterprise Risk Management (ERM) covering strategic, operational, project, financial, compliance and HSSE risks, in order to maximize opportunity and safeguard shareholder value.

Dana Gas has a robust risk management process across the Group, which ensures risk is considered at every level of the organization. There is a bottom up escalation from the country level and functions to the Group and from the Board down to the country level and functions. On an annual basis the Executive Committee carries out an assessment of the principal risks facing the Group. The key risks are submitted and discussed at the Board level and the management of these principal risks is delegated to the Executive Team and Senior Management and is overseen by the Board of Directors and its Committees.

Board and executive responsibility

The Board provides strategic oversight and stewardship of the Company and has a particular responsibility for maintaining effective risk management and internal control systems. This includes evaluating risks to the delivery of the business and strategic plan and oversight on mitigating strategies. The Audit & Compliance Committee (A&CC) has delegated responsibility from the Board for oversight of the risk management process, supported by Group Internal Audit. Risk management is also an integral part of the annual business planning process and ongoing business performance management. Key strategic risks and opportunities are reviewed quarterly by the Board and the A&CC.

The Executive team, Group functional heads and Business delivery teams are responsible and accountable for monitoring and managing the risks in their parts of the business. Individual leaders and managers identify and assess the probability and impact of day-to-day risks and decide, within their levels of authority, whether they should be terminated or brought to an acceptable level to meet the Board expectations.

Risk management process

The risk registers and maps capture risks facing the Group and assess these, at both an inherent and residual level, against their likelihood and their potential impact to the Group. The impact includes financial, HSSE, timeline and reputation. The risk owners use these assessments to understand how strong existing controls are and what mitigating actions are taken. Throughout the Risk Management process assurances are obtained at each level from Business Unit.

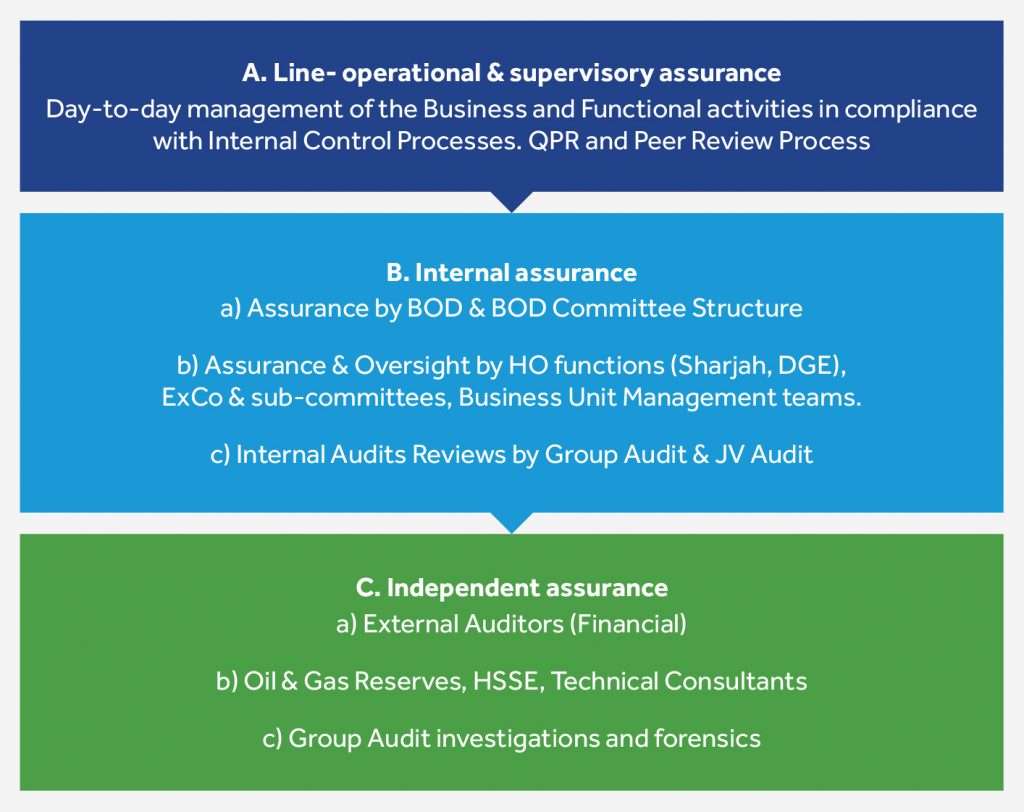

Dana Gas risk management assurance processes

Risk factors and uncertainties

Dana Gas businesses in the MENA region are exposed to a number of risks and uncertainties, which could, either on their own or in combination with others, potentially have a material effect on the Group’s strategy, business performance or reputation. These include:

- Receivables and liquidity

- Geo-political and sovereign risk

- Inability to replenish depleted reserves

- Corporate and project funding

- Asset performance and asset integrity

- HSSE

- Access to new gas markets and the competitive environment

- Corporate reputation and license to operate

- People resource and succession planning

- Insurance

- Other risks such as commodity prices, stakeholder management and cyber security

For further information on the current status of Dana Gas risk management, review the risk section in the

Annual Report 2023.

Internal Audit

Following a review of its Internal Audit Processes in 2019, by the Internal Auditors Association (IAA UAE), Dana Gas has achieved the highest level of assessment as ‘Generally Conforms’ Download the Certificate.